The Rise of Credit Card Surcharging

Credit card surcharging, or adding a fee to transactions where a customer uses a credit card, has become more popular as businesses seek to offset processing costs. With merchant fees ranging between 1.5% and 3.5%, it’s no surprise that many companies are exploring surcharging as a way to balance the books.

However, not all businesses are jumping on this trend. The decision to implement surcharging comes with its own set of considerations, from legal restrictions to customer perception.

Understanding Credit Card Fees

Credit card processing fees include various charges, such as interchange fees (paid to card-issuing banks), assessment fees (paid to credit card networks like Visa or MasterCard), and payment processor fees. These fees can add up quickly, especially for businesses with high transaction volumes.

Instead of absorbing these costs, surcharging allows businesses to pass them directly to customers. But is it worth the potential downsides?

Pros and Cons of Passing Credit Card Fees to Customers

Pros:

- Reduced Operating Costs: The most obvious advantage is cost savings. Passing processing fees to customers can significantly reduce your business’s operating expenses, especially if your sales involve many credit card transactions.

- Transparency: Charging customers for credit card fees can make them more aware of the costs associated with their preferred payment methods, encouraging them to choose cheaper alternatives like cash or debit cards.

- Improved Profit Margins: By reducing expenses related to card processing, businesses can enjoy improved profit margins without having to increase product or service prices.

Cons:

- Customer Dissatisfaction: One of the biggest risks is potential customer backlash. Many customers expect businesses to absorb the cost of credit card fees and may view surcharging as unfair or greedy, which could harm customer loyalty.

- Legal Restrictions: While credit card surcharging is allowed in many states, some have restrictions or outright bans on the practice. Businesses must ensure they comply with local and federal regulations to avoid penalties.

- Competitive Disadvantage: If your competitors are not passing fees onto their customers, you may lose out on business, especially if price-sensitive consumers can find similar products or services elsewhere without the additional surcharge.

Best Practices for Implementing Surcharging

If you decide to implement surcharging, it’s essential to do so strategically and transparently. Here are a few tips for making the transition smoother:

- Be Transparent: Always inform customers upfront about the surcharge before they complete their purchase. Display clear signage in your store or on your website, and make sure customers know they can avoid the fee by paying with cash or debit.

- Follow the Rules: Ensure you understand and comply with state laws regarding surcharges. In addition, Visa, MasterCard, and other credit card networks have specific rules you must follow, such as not charging more than the cost of the credit card fee itself.

- Customer Service Matters: If customers are upset about the fees, offer alternative payment methods or incentives, like a cash discount. Customer service can help mitigate negative reactions.

Alternatives to Surcharging

If surcharging doesn’t feel like the right fit for your business, there are other ways to manage credit card processing costs:

- Cash Discounts: Rather than adding a fee for credit card transactions, you can offer a discount to customers who pay with cash. This incentivizes the use of cash while still allowing you to avoid credit card processing fees.

- Negotiating with Processors: Many businesses can lower their processing fees by negotiating with their payment processors or shopping around for better deals.

- Optimizing Transactions: Implementing better fraud prevention methods and streamlining transaction processes can reduce the likelihood of chargebacks and related fees, keeping costs under control.

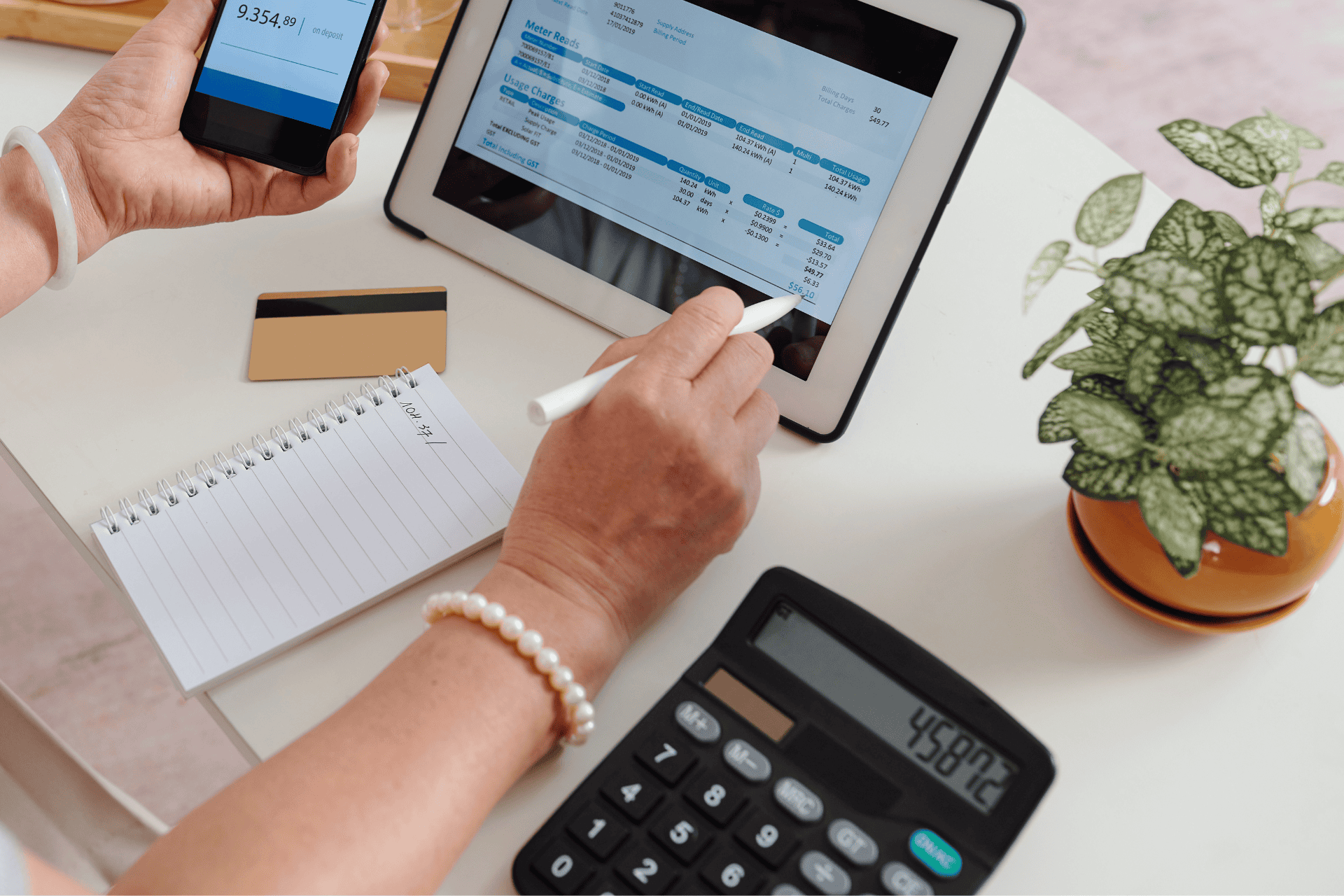

Want Help Exploring Your Options?

Passing credit card fees onto customers can be an effective way to reduce expenses, but it’s not a decision to be taken lightly. Businesses must carefully consider the potential impact on customer satisfaction, compliance with laws, and how they compare to competitors. If you do decide to surcharge, ensure that you’re transparent, compliant, and offering alternative payment options. By weighing the pros and cons, your business can make an informed decision that aligns with its financial goals and customer service standards.

NUR offers comprehensive merchant processing auditing to identify overages from credit card companies and to help our clients choose the best processing path. Contact us today to learn more about these services.